operating cash flow ratio industry average

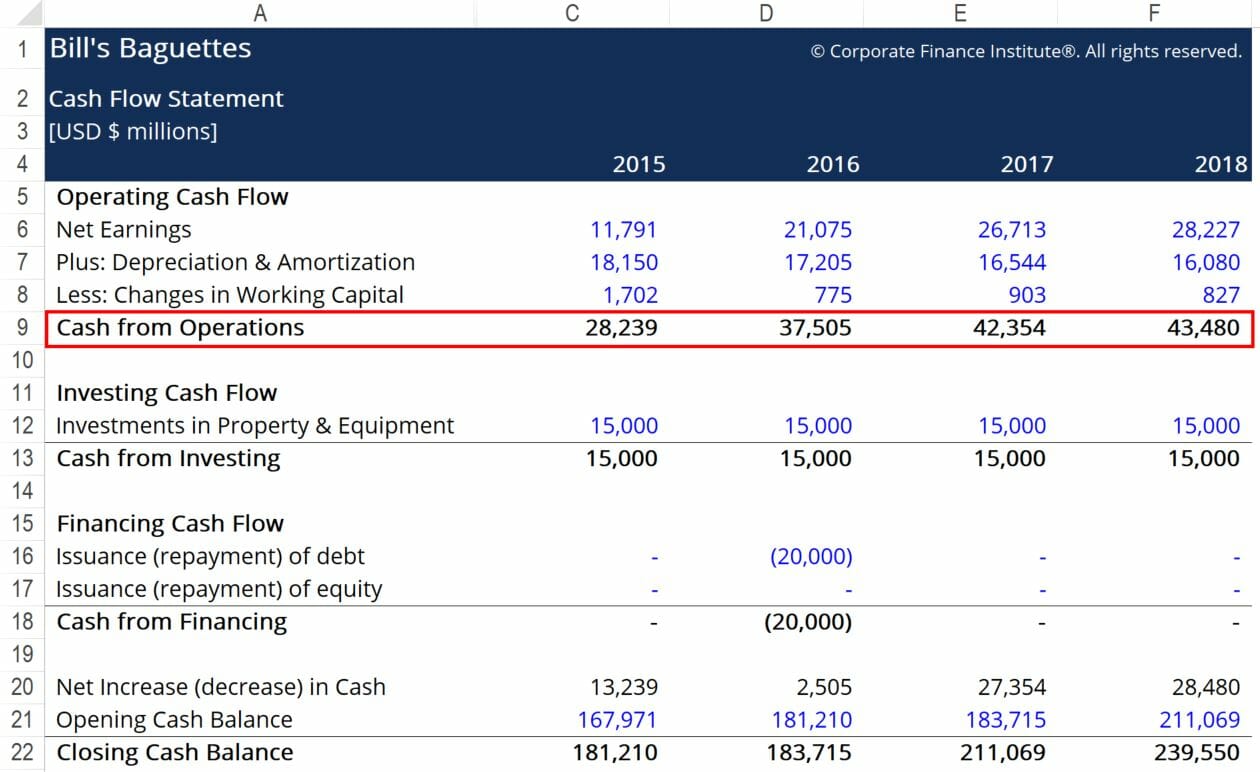

The operating cash flow ratio is a measure of a companys liquidity. Free Cash FlowOperating Cash Flow.

Cash Flow Per Share Formula Example How To Calculate

Cash ratio is a refinement of quick ratio and.

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

. Casinos Gaming Industry Leverage Ratio Statistics as of 4 Q 2021. Ad Learn how companies are getting the most value from working capital in uncertain times. On the trailing twelve months basis total debt decreased faster than Industrys ebitda this led to improvement in Industrys Debt Coverage Ratio to 288.

Operating Income also known as Operating Income Before Interest Expense and Taxes divided by Interest Expense Times Interest Earned Ratio. Industry Ratios included in Value Line. Any of a number of ratios measuring a companys operating efficiency such as sales to cost of goods sold net profit to gross income operating expense to operating income.

If the operating cash flow is less than 1 the company has generated less cash in the period than it. Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance. Price Earnings Price Book.

Operating and Financial Ratios. This compares to 14 for those industries with the largest cash. Operating cash flow ratio is generally calculated using the following formula.

The operating cash flow ratio is a measure of a companys liquidity. Targets operating cash flow ratio works out to 034 or 6 billion divided by 176. The figures cover the period from 1992 to 1996 although.

The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion. This ratio is calculated by dividing operating cash flow a figure that can be obtained from a companys cash flow statement by total debt obligations. Sequentially TTM Free Cash Flow grew by 6601.

Ad Learn how companies are getting the most value from working capital in uncertain times. Financial Ratios for Industry In WRDS. WRDS Industry Financial Ratio WIFR hereafter is a collection of most commonly used financial.

A higher level of cash flow indicates a better ability to withstand declines in. 220 rows An acceptable current ratio aligns with that of the industry average or might be slightly higher than that. Exhibit 1 shows a variety of ratios calculated from the financial statements of Boomtown and Circus Circus.

Financial Soundness 36-51 39. The Operating Cash Flow Ratio a liquidity ratio is a measure of how well a company can pay off its current liabilities Current Liabilities. Total Capital Return on Shareholder Equity Retained Earnings to.

Search this Guide Search. Get the most value from your working capital in uncertain times. The formula to calculate the ratio is as follows.

WRDS Research Team. What is the Operating Cash Flow Ratio. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

The Times Interest Earned Ratio is. Debt Coverage Ratio Comment. Indeed the ten sub-sectors with the lowest cash at 5-8 of sales commanded an operating margin averaging just 6.

Interest coverage ratio. Operating Margin Income Tax Rate Net Profit Margin Return on. 75 rows Cash Ratio - breakdown by industry.

Due to cumulative net new borrowings of 091 in the 4 Q 2021 Liabilities to Equity ratio increased to 488 above Casinos. Industry Comparisons 2017 Industry Average Current 27X Quick 10X Inventory turnover 61X. Get the most value from your working capital in uncertain times.

Cash flow ratios compare cash flows to other elements of an entitys financial statements. This corresponds to a value of 1 or little higher than 1. WRDS Industry Financial Ratio.

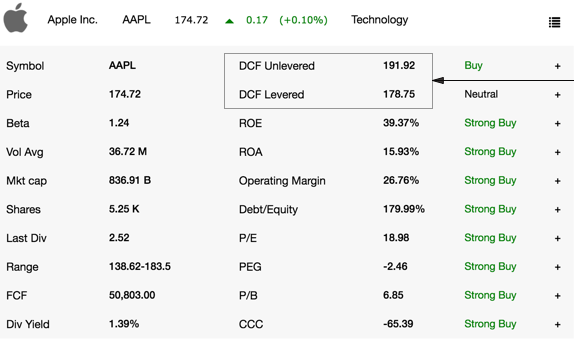

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Ratio Definition

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Operating Cash Flow Ratio India Dictionary

Cash Flow Ratio Analysis Double Entry Bookkeeping

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Formula Example Calculate P Cf Ratio

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Operating Cash Flow Ratio India Dictionary

Price To Cash Flow Ratio P Cf Formula And Calculation

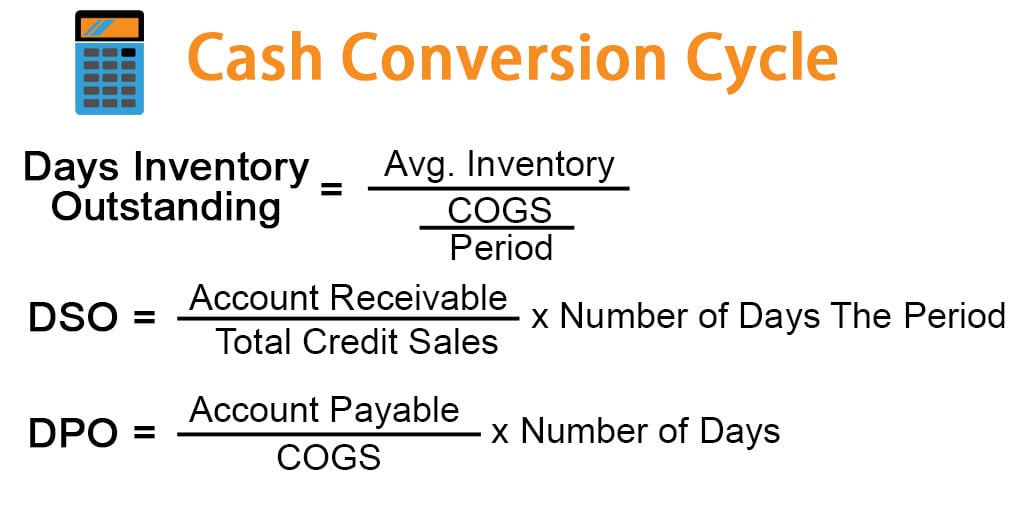

Cash Conversion Cycle Examples Advantages And Disadvantages

Price To Cash Flow Formula Example Calculate P Cf Ratio

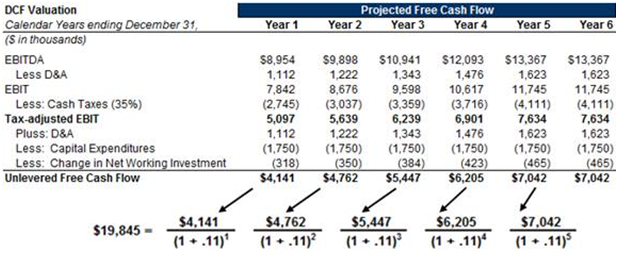

Fcf Formula Formula For Free Cash Flow Examples And Guide

Cash Conversion Cycle Days Accounting Ratio Gmt Research

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Operating Cash Flow Ratio Formula Guide For Financial Analysts